Abacus DFM Literature

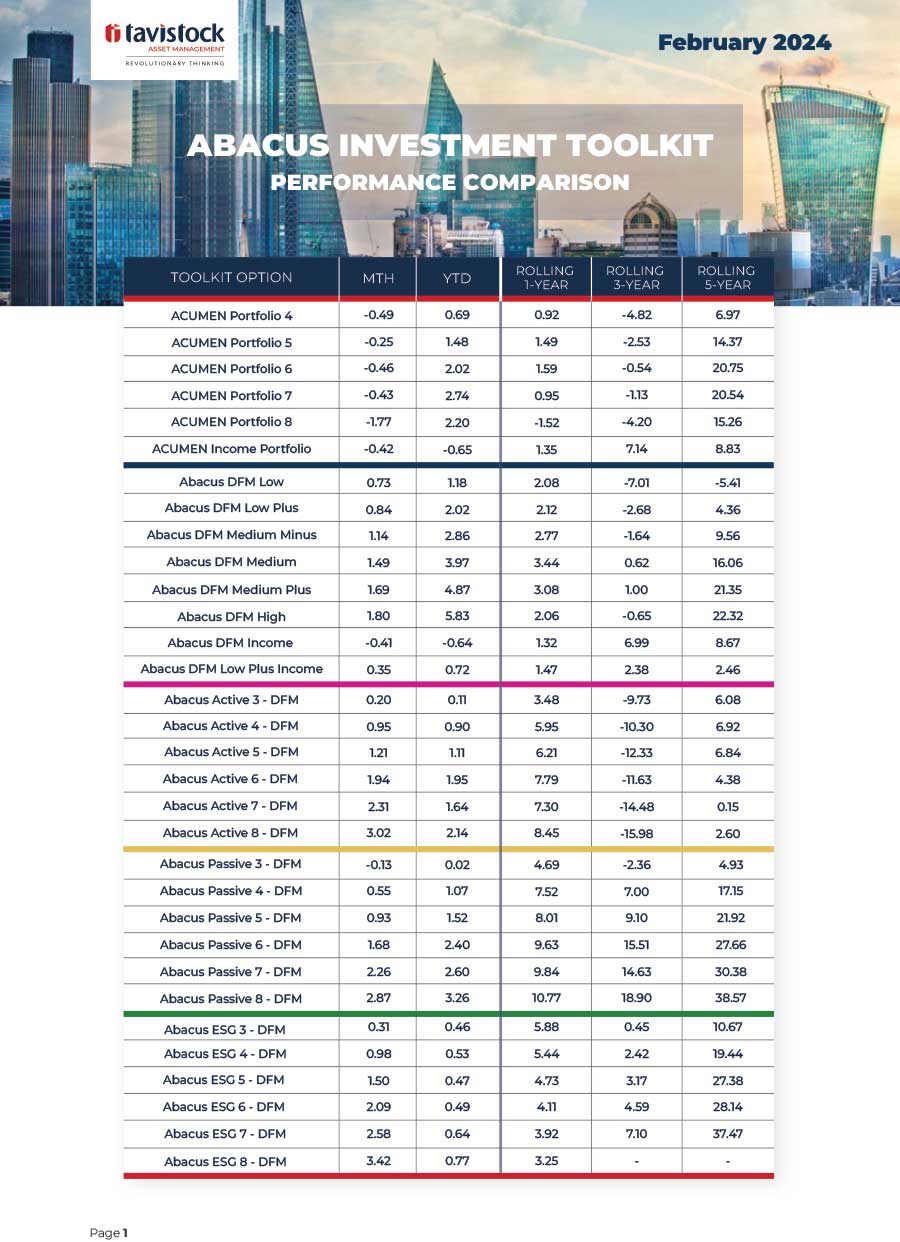

February 2024

Abacus Literature

Abacus Centralised

Investment Proposition

Abacus Passive – DFM Profiles

Quarterly Update (Q4 2023)

Quarterly Perspectives

Q2 2023

Abacus ESG – DFM Profiles

Quarterly Update (Q4 2023)

Quarterly ESG Report TAM

(Q4 2023)

Enviromental, Social &

Governance Investing

Abacus Factsheets – DFM

Abacus Active Profile Factsheets – DFM

Abacus Passive Profile Factsheets – DFM

ESG Update

Most investors in a sustainability-labelled investment product would naturally expect there to be some exposure to the end products of the decarbonisation supply chain, namely things like wind turbines, heat pumps and electric vehicles. Fewer investors would expect there to be exposure to the picks and shovels of this supply chain, for example the manufacturers of copper wiring or steel. Fewer still would expect there to be any exposure to the companies mining the raw materials required to build the steel that is required to build wind turbines. This is mostly because these less visible parts of the supply chain have struggled with a variety of environmental and social challenges for many years. However, since the decarbonisation of our energy system is not possible without the full supply chain (or without complimentary solutions like nuclear power), we think it makes good sense to learn as much about these challenges as we can in order to more fully understand the sustainability risks and opportunities of decarbonisation. To that end, we are currently conducting research with the LSE Green Finance Society on this topic and look forward to sharing our findings in due course. Although not a large part of our investable universe at the moment, we have reason to believe that in the future the less visible parts of the decarbonisation supply chain will begin to feature more in sustainability-labelled investment products, in part thanks to a suite of new product labels that will be introduced later this year as part of the FCA’s Sustainability Disclosure Requirements (SDR).