Abacus DFM Literature

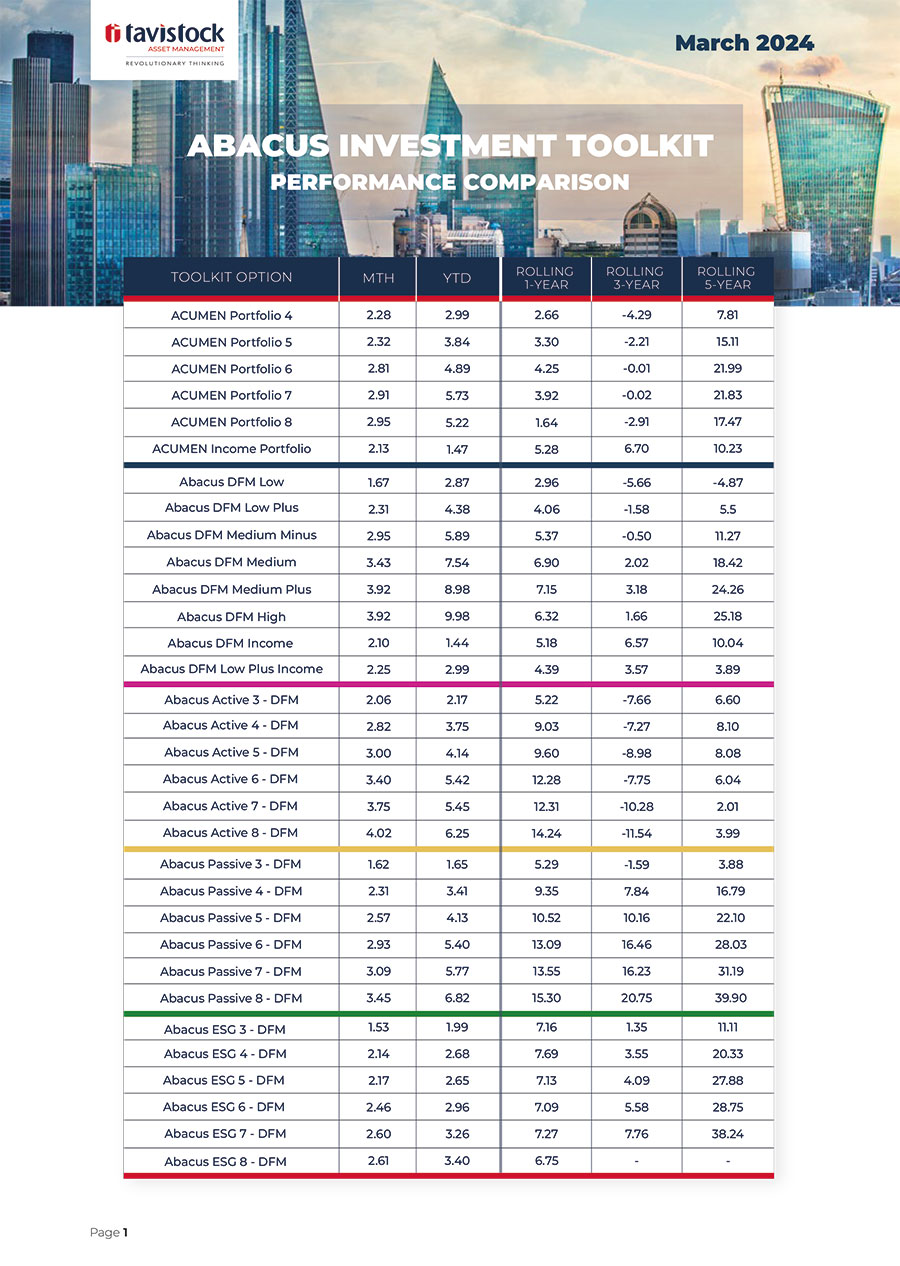

March 2024

Abacus Literature

Abacus Centralised

Investment Proposition

Abacus Passive – DFM Profiles

Quarterly Update (Q4 2023)

Quarterly Perspectives

Q2 2023

Abacus ESG – DFM Profiles

Quarterly Update (Q4 2023)

Quarterly ESG Report TAM

(Q4 2023)

Enviromental, Social &

Governance Investing

Abacus Factsheets – DFM

Abacus Active Profile Factsheets – DFM

Abacus Passive Profile Factsheets – DFM

ESG Update

As it relates to decarbonisation, pragmatism is the new word du jour. Larry Fink, the CEO of BlackRock, has for the last several years used his annual letter to investors to communicate his firm’s thinking about sustainability. In the latest edition, published in March, he emphasised the importance of balancing the energy transition, which will take decades, with energy security, which is top of mind for politicians around the world at the moment due to geopolitical tensions in Europe, the Middle East and elsewhere. His change of tone is also surely a response to the severe backlash amongst Republicans to all things ‘ESG’, a term which Fink has said he no longer uses in client conversations, at least in the USA. It is not just BlackRock. Other large American institutions like JP Morgan, State Street and PIMCO recently departed Climate Action 100+, an investor coalition focused on engaging with the world’s largest corporate greenhouse gas emitters. Several reasons were offered for their exits; however the most likely cause is the coalition’s shift from encouraging disclosure to encouraging action, and the associated consequences of this shift from a legal perspective. The challenge for companies is well-illustrated in a new survey published by the World Economic Forum, which identified a plethora of environmental risks worthy of concern over a longer term horizon, compared to a jumble of environmental, societal and technological risks facing the global economy over the next few years. Greenhushing, the practice of doing good work on sustainability but not talking about it, is flourishing as a result.